18.2 Alternatives in Pollution Control

Learning Objectives

- Explain why command-and-control approaches to reducing pollution are inefficient.

- Explain what is meant by incentive approaches to pollution reduction and discuss examples of them, explaining their advantages and disadvantages.

Suppose that the goal of public policy is to reduce the level of emissions. Three types of policy alternatives could be applied. The first is persuasion—people can be exhorted to reduce their emissions. The second relies on direct controls, and the third uses incentives to induce reductions in emissions.

Moral Suasion

Back in the days when preventing forest fires was a goal of public policy, a cartoon character called Smokey the Bear once asked us to be careful with fire. Signs everywhere remind us not to litter. Some communities have mounted campaigns that admonish us to “Give a hoot—don’t pollute.”

These efforts to influence our choices are examples of moral suasion, an effort to change people’s behavior by appealing to their sense of moral values. Moral suasion is widely used as a tactic in attempting to reduce pollution. It has, for example, been fairly successful in campaigns against littering, which can be considered a kind of pollution. Efforts at moral suasion are not generally successful in reducing activities that pollute the air and water. Pleas that people refrain from driving on certain days when pollution is very great, for example, achieve virtually no compliance.

Moral suasion appears to be most effective in altering behaviors that are not already widespread and for which the cost of compliance is low. It is easy to be careful with one’s fires or to avoid littering.

Moral suasion does not, however, appear to lead to significant changes in behavior when compliance costs are high or when the activity is already widely practiced. It is therefore not likely to be an effective tool for reducing most forms of pollution.

Command and Control

In the most widely used regulatory approach to environmental pollution, a government agency tells a polluting agent how much pollution it can emit or requires the agent to use a particular production method aimed at reducing emissions. This method, in which the government agency tells a firm or individual how much or by what method emissions must be adjusted, is called the command-and-control-approach.

Economists are generally critical of the command-and-control approach for two reasons. First, it achieves a given level of emissions reduction at a higher cost than what would be required to achieve that amount of reduction if market incentives (discussed below) were implemented. Second, it gives polluters no incentive to explore technological and other changes that might reduce the demand for emissions.

Suppose two firms, A and B, each dump 500 tons of a certain pollutant per month and that there is no fee imposed (that is, the price for their emissions equals zero). Total emissions for the two firms thus equal 1,000 tons per month. The pollution control authority decides to cut this in half and orders each firm to reduce its emissions to 250 tons per month, for a total reduction of 500 tons. This is a command-and-control regulation because it specifies the amount of reduction each firm must make. Although it may seem fair to require equal reductions by the two firms, this approach is likely to generate excessive costs.

Suppose that Firm A is quite old and that the reduction in emissions to 250 tons per period would be extremely costly. Suppose that removing the 251st ton costs this firm $1,000 per month. Put another way, the marginal benefit to Firm A of emitting the 251st ton would be $1,000.

Suppose Firm B, a much newer firm, already has some pollution-control equipment in place. Reducing its emissions to 250 tons imposes a cost, but a much lower cost than to Firm A. Indeed, suppose Firm B could reduce its emissions to 249 tons at an additional cost of $100; the marginal benefit to Firm B of emitting the 249th ton is $100.

If two firms have different marginal benefits of emissions, the allocation of resources is inefficient. The same level of emissions could be achieved at a lower cost. Suppose, for example, Firm A is permitted to increase its emissions to 251 tons while Firm B reduces emissions to 249. Firm A saves $1,000, while the cost to Firm B is just $100. Society achieves a net gain of $900, and the level of emissions remains at 500 tons per month.

As long as Firm A’s marginal benefit of emissions exceeds Firm B’s, a saving is realized by shifting emissions from B to A. At the point at which their marginal benefits are equal, no further reduction in the cost of achieving a given level of emissions is possible, and the allocation of emissions is efficient. When a given reduction in emissions is achieved so that the marginal benefit of an additional unit of emissions is the same for all polluters, it is a least-cost reduction in emissions. A command-and-control approach is unlikely to achieve a least-cost reduction in emissions.

The inefficiency of command-and-control regulation is important for two reasons. First, of course, it wastes scarce resources. If the same level of air or water quality could be achieved at a far lower cost, then surely it makes sense to use the cheaper method. Perhaps even more significant, reliance on command-and-control regulation makes environmental quality far more expensive than it needs to be—and that is likely to result in an unwillingness to achieve the improvements that would be economically efficient.

There is a further difficulty with the command-and-control approach. Once firms A and B have been told to reduce their emissions to 250 tons per period, neither firm has an incentive to try to do better. Neither firm will engage in research seeking to reduce its emissions below 250 tons.

Another way to see the difficulty with command-and-control approaches to pollution control is to imagine that a similar method were in use for other resource allocation problems. Suppose, for example, that labor were allocated according to a command-and-control mechanism. Rather than leaving labor allocation to the marketplace, suppose that firms were simply told how much labor to use. Such a system would clearly be unworkable.

Incentive Approaches

Markets allocate resources efficiently when the price system confronts decision makers with the costs and benefits of their decisions. Prices create incentives—they give producers an incentive to produce more and consumers an incentive to economize. Regulatory efforts that seek to create market-like incentives to encourage reductions in pollution, but that allow individual decision makers to determine how much to pollute, are called incentive approaches.

Emissions Taxes

One incentive approach to pollution control relies on taxes. If a tax is imposed on each unit of emissions, polluters will reduce their emissions until the marginal benefit of emissions equals the tax, and a least-cost reduction in emissions is achieved.

Emissions taxes are widely used in Europe. France, for example, has enacted taxes on the sulfur dioxide and nitrous oxide emissions of power plants and other industrial firms. Spain has imposed taxes on the dumping of pollutants into the country’s waterways. Emissions taxes have long been imposed on firms that dump pollutants into some river systems in Europe.

Emissions taxes are also being used in economies making the transition from socialism to a market system. In China, taxes are used to limit the emission by firms of water pollutants. By law, 80% of the money collected from these taxes goes back to the firms themselves for emissions control projects. The tax in China is a rudimentary one. The level of a firm’s emissions is determined by visual inspection of the water just downstream from the point at which the firm emits pollutants. Taxes are imposed based on a guess as to how much the firm has emitted. A similar approach is used in China to limit emissions of particulate matter, an important air pollutant. While the method appears primitive, it is nevertheless successful. During the 1990s, China had the fastest growing economy in the world. Total economic activity increased in China at an annual rate of about 10% per year. Despite this phenomenal increase in economic activity, international estimates of China’s emissions of particulates suggest that they were down 50% during the decade. China’s emissions of effluents were unchanged during this period of phenomenal growth.

Taxes are also used to limit pollution in the countries of the former Soviet Union. Rather than basing taxes on an estimate of marginal cost, taxes are set according to complicated engineering formulae. In Lithuania, for example, the tax on sulfide emissions in the water has been set at several million dollars per ton. Needless to say, that tax is not even collected.

The important role for pollution taxes in improving environmental quality is often misunderstood. For example, an intriguing battle in the courts followed Argentina’s attempt to use taxes to control air pollution. Environmental groups went to federal court, charging that the taxes constituted a “license to pollute.” The unfortunate result was that the Argentine government withdrew its effort to control pollution through taxation without finding an adequate substitute policy1.

An emissions tax requires, of course, that a polluter’s emissions be monitored. The polluter is then charged a tax equal to the tax per unit times the quantity of emissions. The tax clearly gives the polluter an incentive to reduce emissions. It also ensures that reductions will be accomplished by those polluters that can achieve them at the lowest cost. Polluters for whom reductions are most costly will generally find it cheaper to pay the emissions tax.

In cases where it is difficult to monitor emissions, a tax could be imposed indirectly. Consider, for example, farmers’ use of fertilizers and pesticides. Rain may wash some of these materials into local rivers, polluting the water. Clearly, it would be virtually impossible to monitor this runoff and assess responsible farmers a charge for their emissions. But it would be possible to levy a tax on these materials when they are sold, confronting farmers with a rough measure of the cost of the pollution their use of these materials imposes.

Marketable Pollution Permits

An alternative to emissions taxes is marketable pollution permits, which allow their owners to emit a certain quantity of pollution during a particular period. The introduction to this chapter dealt with an example of marketable pollution permits; each of the permits to dump a metric ton of greenhouse gases that is purchased results in a reduction in the cost of meeting the goal of reducing the emissions of these gases.

To see how this works, suppose that Firms A and B are again told that they must reduce their emissions to 250 tons of a pollutant per month. This time, however, they are given 250 permits each—one permit allows the emission of one ton per month. They can trade their permits; a firm that emits less than its allotted 250 tons can sell some of its permits to another firm that wants to emit more.

We saw that Firm B can reduce its emissions below 250 tons for a much lower cost than Firm A. For example, it could reduce its emissions to 249 tons for $100. Firm A would be willing to pay $1,000 for the right to emit the 251st ton of emissions. Clearly, a mutually profitable exchange is possible. In fact, as long as their marginal benefits of pollution differ, the firms can profit from exchange. Equilibrium will be achieved at the least-cost solution at which the marginal benefits for both firms are equal.

One virtue of using marketable permits is that this approach represents only a modest departure from traditional command-and-control regulation. Once a polluter has been told to reduce its emissions to a certain quantity, it has a right to emit that quantity. Polluters will exchange rights only if doing so increases their utility or profits—allowing rights to be exchanged can only make them better off. Another benefit, of course, is that such exchanges allow a shift from the inefficient allocation created by command-and-control regulation to an efficient allocation in which pollution is reduced at the lowest possible cost. Finally, each firm will have an incentive to explore ways to reduce its emissions further, either to be able to sell more rights or to require purchasing fewer permits.

Merits of Incentive Approaches

Incentive systems, either emissions taxes or tradable permits, can achieve reductions in emissions at a far lower cost than command-and-control regulation. Even more important, however, are the long-run incentives they create for technological change. A firm that is ordered to reduce its emissions to a certain level has no incentive to do better, whereas a firm facing an emissions tax has a constant incentive to seek out new ways to lower its emissions and thus lower its taxes. Similarly, a firm faces a cost for using an emissions permit—the price that could be obtained from selling the permit—so it will seek ways to reduce emissions. As firms discover new ways to lower their costs of reducing emissions, the demand for emissions permits will fall, lowering the efficient quantity of emissions—and improving environmental quality even further.

Public Policy and Pollution: The Record

Federal efforts to control air and water pollution in the United States have produced mixed results. Air quality has generally improved; water quality has improved in some respects but deteriorated in others.

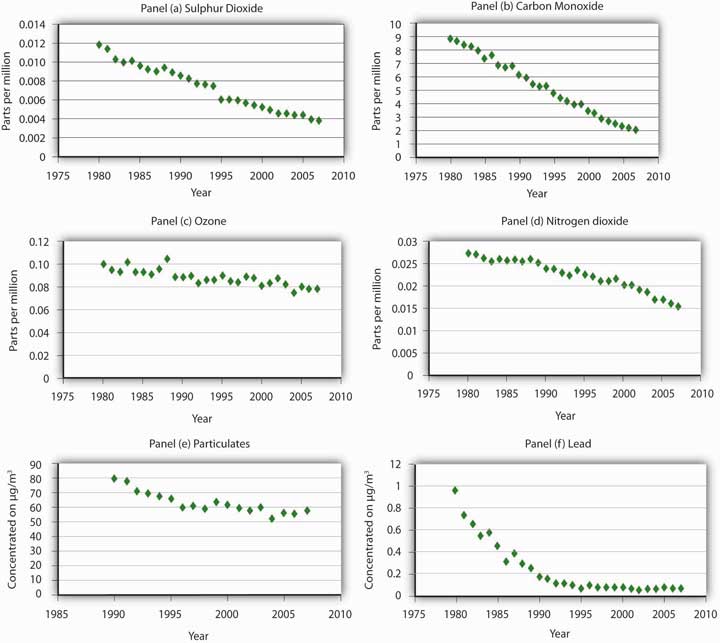

Figure 18.7 “U.S. Air Pollution Levels, 1975–2003” shows how annual average concentrations of airborne pollutants in major U.S. cities have declined since 1975. Lead concentrations have dropped most dramatically, largely because of the increased use of unleaded gasoline.

Figure 18.7 U.S. Air Pollution Levels, 1975–2003

The average concentration of major air pollutants in U.S. cities has declined since 1975.

Source: U.S. Bureau of the Census, Statistical Abstract of the United States, 2006 (Washington, D.C.: U.S. Government Printing Office, 2006), Table 359, p. 228. Observations before 1999 are taken from previous volumes of the abstract; supplemented by National Air Quality and Emissions Trends Report, 2003, Table A-1b (Environmental Protection Agency, 2005).

Public policy has generally stressed command-and-control approaches to air and water pollution. To reduce air pollution, the EPA sets air quality standards that regions must achieve, then tells polluters what adjustments they must make in order to meet the standards. For water pollution, the Environmental Protection Agency (EPA) has set emissions limits based on the technologies it considers reasonable to require of polluters. If the implementation of a particular technology will reduce a polluter’s emissions by 20%, for example, the EPA will require a 20% reduction in emissions. National standards have been imposed; no effort has been made to consider the benefits and costs of pollution in individual streams. Further, the EPA’s technology-based approach pays little attention to actual water quality—and has produced few gains.

Moreover, environmental problems go beyond national borders. For example, sulfur dioxide emitted from plants in the United States can result in acid rain in Canada and elsewhere. Another possible pollution problem that extends across national borders is suggested by the global warming hypothesis.

Many scientists have argued that increasing emissions of greenhouse gases, caused partly by the burning of fossil fuels, trap ever more of the sun’s energy and make the planet warmer. Global warming, they argue, could lead to flooding of coastal areas, losses in agricultural production, and the elimination of many species. If this global warming hypothesis is correct, then carbon dioxide is a pollutant with global implications, one that calls for a global solution.

At the 1997 United Nations conference in Kyoto, Japan, the industrialized countries agreed to cuts in carbon dioxide emissions of 5.2% below the 1990 level by 2010. At the 1998 conference in Buenos Aires, Argentina, 170 countries agreed on a two-year action plan for designing mechanisms to reduce emissions and procedures to encourage transfers of new energy technologies to developing countries.

While the delegates to the conferences sign the various protocols, countries are not bound by them until ratified by appropriate governmental bodies. By 2005, the vast majority of the world’s nations had ratified the agreement. The United States had neither signed nor ratified the agreement.

Debates at these conferences have been over the extent to which developing countries should be required to reduce their emissions and over the role that market mechanisms should play. Developing countries argue that their share in total emissions is fairly small and that it is unfair to ask them to give up economic growth, given their lower income levels. As for how emissions reductions will be achieved, the United States has been the strongest advocate for emissions trading in which each country would receive a certain number of tradable emissions rights. This provision has been incorporated in the agreement.

That market approaches have entered the national and international debates on dealing with environmental issues, and to a large extent have even been used, demonstrates the power of economic analysis. Economists have long argued that as pollution-control authorities replace command-and-control strategies with incentive approaches, society will reap huge savings. The economic argument has rested on acknowledging the opportunity costs of addressing environmental concerns and thus has advocated policies that achieve improvements in the environment in the least costly ways.

Key Takeaways

- Public sector intervention is generally needed to move the economy toward the efficient solution in pollution problems.

- Command-and-control approaches are the most widely used methods of public sector intervention, but they are inefficient.

- The exchange of pollution rights can achieve a given reduction in emissions at the lowest cost possible. It also creates incentives to reduce pollution demand through technological change.

- Tax policy can also achieve a least-cost reduction in emissions.

Try It!

Based on your answer to the previous Try It! problem, a tax of what amount would result in the efficient quantity of pollution?

Case in Point: Road Pricing in Singapore

The urban highways of virtually every city in the world are heavily congested in what is fancifully referred to as the “rush hour.” Traffic during this period hardly rushes. The problem of traffic congestion is analogous to the problem of pollution, and it lends itself to the same solution.

Suppose that you are driving into any major city on a weekday at eight o’clock in the morning. The highway is congested when you drive onto it. Your car adds to that congestion. You, of course, experience the average level of congestion. But, your car slows every car behind you on the highway by a small amount. Multiplying that extra slowing by the number of cars behind you gives the marginal delay of adding your own car to an already congested highway. That marginal cost is many times greater than the average cost that you actually face. The result is an inefficient solution in which roads are congested far beyond the point that would be economically efficient. The late William Vickrey, who won the Nobel Prize for his work in the economics of public finance, advocated a system of road pricing that would put an end to congested highways.

Mr. Vickrey’s dream is a reality in Singapore. The island-nation’s 700,000 cars are each required to subscribe to the Electronic Road Pricing (ERP) system and to have an ERP card on their windshield. Further, each driver is required to maintain a deposit of electronic cash in the card. Tolls are charged during rush hour for the highways leading into the downtown area. There is also a charge for using downtown streets. Tolls range from $0.50 to $1.00 and are only levied if the road threatens to become congested. Using highways and streets is free at other times. ERP managers adjust the tolls to avoid “jam-ups,” as they are called in Singapore. Managers attempt to keep traffic flowing at 30 to 40 mph on the highways and 15 to 20 mph on downtown streets.

When a car passes an electronic gurney, it automatically takes the charge out of the ERP card on the windshield. When a charge is taken from the card, the driver hears a beep. If the card balance falls below $5, several beeps are heard. The cards can be placed in ATMs to put additional funds in them. A car that does not have enough money in its card is photographed and the owner of the car receives a $45 citation in the mail. The tolls keep casual drivers off the roads during rush hour. Commuters generally find it cheaper to use the island’s excellent rapid transit system.

The system is not universally popular. People in Singapore refer to the system as “Eternally Raising Prices.” The manager of the system, Hiok Seng Tan, rejects the criticism. “It’s not just a system to get more money of Singaporeans,” he told the Boston Globe. In fact, the system takes in only $44 million per year; the money is used to maintain the system.

Singapore’s system is an example of a price system to manage what is, in effect, a pollution problem. It appears to be effective. Jam-ups are uncommon. Would such a system work in other areas? The idea is not politically popular. Gregory B. Christainsen, a professor of economics at California State University at East Bay, notes that Singapore is dominated by a single party and questions whether other urban areas are ready for the approach. Still, the system works and the concept is one more urban areas should consider.

Sources: Alex Beam, “Where Traffic Has Been Tamed,” Boston Globe, (May 2, 2004): M-7; Gregory B. Christainsen, “Road Pricing in Singapore after 30 Years,” Cato Journal, 26(1) (Winter 2006): 71–88.

Answer to Try It! Problem

The paper mill will reduce its pollution until the marginal benefit of polluting equals the tax. In this case a tax of $70 would cause the paper mill to reduce its pollution to 4 tons, the efficient level. At pollution levels below that amount, the marginal benefit of polluting exceeds the tax, and so the paper mill is better off polluting and paying the tax. At pollution levels greater than that amount, the marginal benefit of polluting is less than the tax.

1The observations on pollution taxes in China, Argentina, and Lithuania are from Randall A. Bluffstone, “Environmental Taxes in Developing and Transition Economies,” Public Finance & Management 3(1) (Spring, 2003): 143–75.