13.2 Financial Institutions

Learning Objectives

- Distinguish among different types of financial institutions.

- Discuss the services that financial institutions provide and explain their role in expanding the money supply.

For financial transactions to happen, money must change hands. How do such exchanges occur? At any given point in time, some individuals, businesses, and government agencies have more money than they need for current activities; some have less than they need. Thus, we need a mechanism to match up savers (those with surplus money that they’re willing to lend out) with borrowers (those with deficits who want to borrow money). We could just let borrowers search out savers and negotiate loans, but the system would be both inefficient and risky. Even if you had a few extra dollars, would you lend money to a total stranger? If you needed money, would you want to walk around town looking for someone with a little to spare?

Depository and Nondepository Institutions

Now you know why we have financial institutions: they act as intermediaries between savers and borrowers and they direct the flow of funds between them. With funds deposited by savers in checking, savings, and money market accounts, they make loans to individual and commercial borrowers. In the next section, we’ll discuss the most common types of depository institutions (banks that accept deposits), including commercial banks, savings banks, and credit unions. We’ll also discuss several nondepository institutions (which provide financial services but don’t accept deposits), including finance companies, insurance companies, brokerage firms, and pension funds.

Commercial Banks

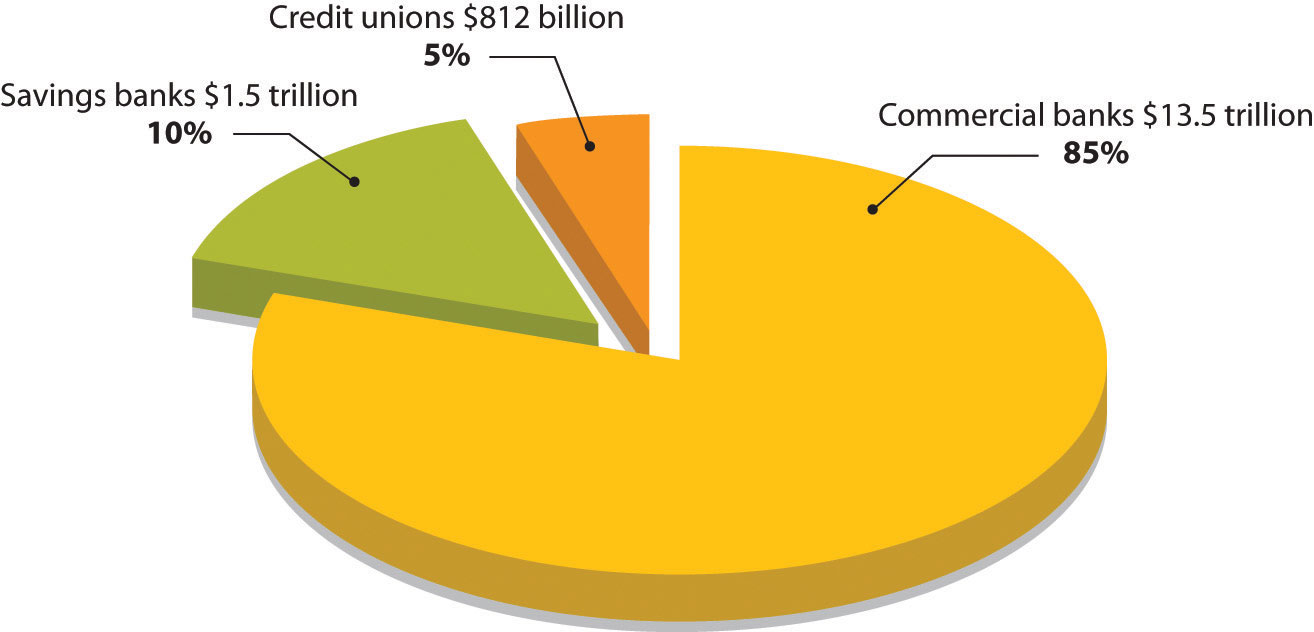

Commercial banks are the most common financial institutions in the United States, with total financial assets of about $13.5 trillion (85 percent of the total assets of the banking institutions) (Insurance Information Institute, 2011). They generate profit not only by charging borrowers higher interest rates than they pay to savers but also by providing such services as check processing, trust- and retirement-account management, and electronic banking. The country’s 7,000 commercial banks range in size from very large (Bank of America, J.P. Morgan Chase) to very small (local community banks). Because of mergers and financial problems, the number of banks has declined significantly in recent years, but, by the same token, surviving banks have grown quite large. If you’ve been with one bank over the past ten years or so, you’ve probably seen the name change at least once or twice.

Savings Banks

Savings banks (also called thrift institutions and savings and loan associations, or S&Ls) were originally set up to encourage personal saving and provide mortgages to local home buyers. Today, however, they provide a range of services similar to those offered by commercial banks. Though not as dominant as commercial banks, they’re an important component of the industry, holding total financial assets of almost $1.5 trillion (10 percent of the total assets of the banking institutions) (Insurance Information Institute, 2010). The largest S&L, Sovereign Bancorp, has close to 750 branches in nine Northeastern states. Savings banks can be owned by their depositors (mutual ownership) or by shareholders (stock ownership).

Credit Unions

To bank at a credit union, you must be linked to a particular group, such as employees of United Airlines, employees of the state of North Carolina, teachers in Pasadena, California, or current and former members of the U.S. Navy. Credit unions are owned by their members, who receive shares of their profits. They offer almost anything that a commercial bank or savings and loan does, including savings accounts, checking accounts, home and car loans, credit cards, and even some commercial loans (Pennsylvania Association of Community Bankers, 2011). Collectively, they hold about $812 billion in financial assets (around 5 percent of the total assets of the financial institutions).

Figure 13.3 “Where Our Money Is Deposited” summarizes the distribution of assets among the nation’s depository institutions.

Finance Companies

Finance companies are nondeposit institutions because they don’t accept deposits from individuals or provide traditional banking services, such as checking accounts. They do, however, make loans to individuals and businesses, using funds acquired by selling securities or borrowed from commercial banks. They hold about $1.9 trillion in assets (Insurance Information Institute, 2010). Those that lend money to businesses, such as General Electric Capital Corporation, are commercial finance companies, and those that make loans to individuals or issue credit cards, such a Citgroup, are consumer finance companies. Some, such as General Motors Acceptance Corporation, provide loans to both consumers (car buyers) and businesses (GM dealers).

Insurance Companies

Insurance companies sell protection against losses incurred by illness, disability, death, and property damage. To finance claims payments, they collect premiums from policyholders, which they invest in stocks, bonds, and other assets. They also use a portion of their funds to make loans to individuals, businesses, and government agencies.

Brokerage Firms

Companies like A.G. Edwards & Sons and T. Rowe Price, which buy and sell stocks, bonds, and other investments for clients, are brokerage firms (also called securities investment dealers). A mutual fund invests money from a pool of investors in stocks, bonds, and other securities. Investors become part owners of the fund. Mutual funds reduce risk by diversifying investment: because assets are invested in dozens of companies in a variety of industries, poor performance by some firms is usually offset by good performance by others. Mutual funds may be stock funds, bond funds, and money market funds, which invest in safe, highly liquid securities. (Recall our definition of liquidity in Chapter 12 “The Role of Accounting in Business” as the speed with which an asset can be converted into cash.)

Finally, pension funds, which manage contributions made by participating employees and employers and provide members with retirement income, are also nondeposit institutions.

Financial Services

You can appreciate the diversity of the services offered by commercial banks, savings banks, and credit unions by visiting their Web sites. For example, Wells Fargo promotes services to four categories of customers: individuals, small businesses, corporate and institutional clients, and affluent clients seeking “wealth management.” In addition to traditional checking and savings accounts, the bank offers automated teller machine (ATM) services, credit cards, and debit cards. It lends money for homes, cars, college, and other personal and business needs. It provides financial advice and sells securities and other financial products, including individual retirement account (IRA), by which investors can save money that’s tax free until they retire. Wells Fargo even offers life, auto, disability, and homeowners insurance. It also provides electronic banking for customers who want to check balances, transfer funds, and pay bills online (Wells Fargo, 2011).

Bank Regulation

How would you react if you put your life savings in a bank and then, when you went to withdraw it, learned that the bank had failed—that your money no longer existed? This is exactly what happened to many people during the Great Depression. In response to the crisis, the federal government established the Federal Depository Insurance Corporation (FDIC) in 1933 to restore confidence in the banking system. The FDIC insures deposits in commercial banks and savings banks up to $250,000. So today if your bank failed, the government would give you back your money (up to $250,000). The money comes from fees charged member banks.

To decrease the likelihood of failure, various government agencies conduct periodic examinations to ensure that institutions are in compliance with regulations. Commercial banks are regulated by the FDIC, savings banks by the Office of Thrift Supervision, and credit unions by the National Credit Union Administration. As we’ll see later in the chapter, the Federal Reserve System also has a strong influence on the banking industry.

Crisis in the Financial Industry (and the Economy)

What follows is an interesting, but scary, story about the current financial crisis in the banking industry and its effect on the economy. In the years between 2001 and 2005, lenders made billions of dollars in subprime adjustable-rate mortgages (ARMs) to American home buyers. Subprime loans are made to home buyers who don’t qualify for market-set interest rates because of one or more risk factors—income level, employment status, credit history, ability to make only a very low down payment. In 2006 and 2007, however, housing prices started to go down. Many homeowners with subprime loans, including those with ARMs whose rates had gone up, were able neither to refinance (to lower their interest rates) nor to borrow against their homes. Many of these homeowners got behind in mortgage payments, and foreclosures became commonplace—1.3 million in 2007 alone (Lahart, 2011). By April 2008, 1 in every 519 American households had received a foreclosure notice (RealtyTrac Inc., 2011). By August, 9.2 percent of the $12 trillion in U.S. mortgage loans was delinquent or in foreclosure (Mortgage Bankers Association, 2008; Duhigg, 2011).

The repercussions? Banks and other institutions that made mortgage loans were the first sector of the financial industry to be hit. Largely because of mortgage-loan defaults, profits at more than 8,500 U.S. banks dropped from $35 billion in the fourth quarter of 2006 to $650 million in the corresponding quarter of 2007 (a decrease of 89 percent). Bank earnings for the year 2007 declined 31 percent and dropped another 46 percent in the first quarter of 2008 (Federal Deposit Insurance Corporation, 2008; FDIC, 2008).

Losses in this sector were soon felt by two publicly traded government-sponsored organizations, the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac). Both of these institutions are authorized to make loans and provide loan guarantees to banks, mortgage companies, and other mortgage lenders; their function is to make sure that these lenders have enough money to lend to prospective home buyers. Between them, Fannie Mae and Freddie Mac backed approximately half of that $12 trillion in outstanding mortgage loans, and when the mortgage crisis hit, the stock prices of the two corporations began to drop steadily. In September 2008, amid fears that both organizations would run out of capital, the U.S. government took over their management.

Freddie Mac also had another function: to increase the supply of money available in the country for mortgage loans and new home purchases, Freddie Mac bought mortgages from banks, bundled these mortgages, and sold the bundles to investors (as mortgage-backed securities). The investors earned a return because they received cash from the monthly mortgage payments. The banks that originally sold the mortgages to Freddie Mac used the cash they got from the sale to make other loans. So investors earned a return, banks got a new influx of cash to make more loans, and individuals were able to get mortgages to buy the homes they wanted. This seemed like a good deal for everyone, so many major investment firms started doing the same thing: they bought individual subprime mortgages from original lenders (such as small banks), then pooled the mortgages and sold them to investors.

But then the bubble burst. When many home buyers couldn’t make their mortgage payments (and investors began to get less money and consequently their return on their investment went down), these mortgage-backed securities plummeted in value. Institutions that had invested in them—including investment banks—suffered significant losses (Tully, 2007). In September 2008, one of these investment banks, Lehman Brothers, filed for bankruptcy protection; another, Merrill Lynch, agreed to sell itself for $50 billion. Next came American International Group (AIG), a giant insurance company that insured financial institutions against the risks they took in lending and investing money. As its policyholders buckled under the weight of defaulted loans and failed investments, AIG, too, was on the brink of bankruptcy, and when private efforts to bail it out failed, the U.S. government stepped in with a loan of $85 billion (Robb, et. al., 2008). The U.S. government also agreed to buy up risky mortgage-backed securities from teetering financial institutions at an estimated cost of “hundreds of billions” (Mortgage Bankers Association, 2008). And the banks started to fail—beginning with the country’s largest savings and loan, Washington Mutual, which had 2,600 locations throughout the country. The list of failed banks kept getting longer: by November of 2008, it had grown to nineteen.

The economic troubles that began in the banking industry as a result of the subprime crisis spread to the rest of the economy. Credit markets froze up and it became difficult for individuals and businesses to borrow money. Consumer confidence dropped, people stopped spending, businesses cut production, sales dropped, company profits fell, and many lost their jobs. It would be nice if this story had an ending (and even nicer if it was positive), but it might take us years before we know the ending. At this point in time, all we do know is that the economy is going through some very difficult times and no one is certain about the outcome. As we head into 2012, one in three Americans believe the United States is headed in the wrong direction. Our debt has been downgraded by Moody’s, a major credit rating agency. Unemployment seems stuck at around 9 percent, with the long-term unemployed making up the biggest portion of the jobless since records began in 1948. “As the superpower’s clout seems to ebb towards Asia, the world’s most consistently inventive and optimistic country has lost its mojo” (The Economist, 2011).

How Banks Expand the Money Supply

When you deposit money, your bank doesn’t set aside a special pile of cash with your name on it. It merely records the fact that you made a deposit and increases the balance in your account. Depending on the type of account, you can withdraw your share whenever you want, but until then, it’s added to all the other money held by the bank. Because the bank can be pretty sure that all its depositors won’t withdraw their money at the same time, it holds on to only a fraction of the money that it takes in—its reserves. It lends out the rest to individuals, businesses, and the government, earning interest income and expanding the money supply.

The Money Multiplier

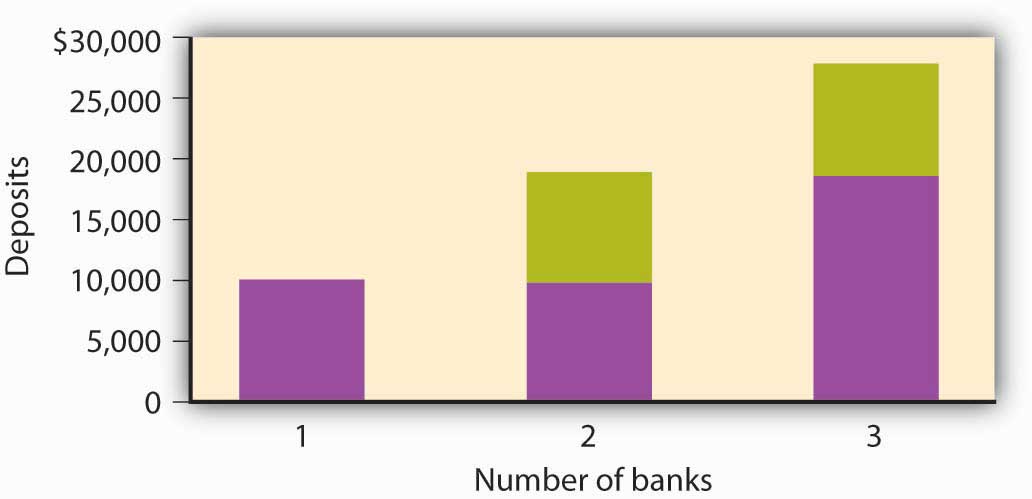

Precisely how do banks expand the money supply? To find out, let’s pretend you win $10,000 at the blackjack tables of your local casino. You put your winnings into your savings account immediately. The bank will keep a fraction of your $10,000 in reserve; to keep matters simple, we’ll use 10 percent. The bank’s reserves, therefore, will increase by $1,000 ($10,000 × 0.10). It will then lend out the remaining $9,000. The borrowers (or the parties to whom they pay it out) will then deposit the $9,000 in their own banks. Like your bank, these banks will hold onto 10 percent of the money ($900) and lend out the remainder ($8,100). Now let’s go through the process one more time. The borrowers of the $8,100 (or, again, the parties to whom they pay it out) will put this amount into their banks, which will hold onto $810 and lend the remaining $7,290. As you can see in Figure 13.4 “The Effect of the Money Multiplier”, total bank deposits would now be $27,100. Eventually, bank deposits would increase to $100,000, bank reserves to $10,000, and loans to $90,000. A shortcut for arriving at these numbers depends on the concept of the money multiplier, which is determined using the following formula:

Money multiplier = 1/Reserve requirement

In our example, the money multiplier is 1/0.10 = 10. So your initial deposit of $10,000 expands into total deposits of $100,000 ($10,000 × 10), additional loans of $90,000 ($9,000 × 10), and increased bank reserves of $10,000 ($1,000 × 10). In reality, the multiplier will actually be less than 10. Why? Because some of the money loaned out will be held as currency and won’t make it back into the banks.

Key Takeaways

- Financial institutions serve as financial intermediaries between savers and borrowers and direct the flow of funds between the two groups.

- Those that accept deposits from customers—depository institutions—include commercial banks, savings banks, and credit unions; those that don’t—nondepository institutions—include finance companies, insurance companies, and brokerage firms.

- Financial institutions offer a wide range of services, including checking and savings accounts, ATM services, and credit and debit cards. They also sell securities and provide financial advice.

- A bank holds onto only a fraction of the money that it takes in—an amount called its reserves—and lends the rest out to individuals, businesses, and governments. In turn, borrowers put some of these funds back into the banking system, where they become available to other borrowers. The money multiplier effect ensures that the cycle expands the money supply.

Exercises

-

(AACSB) Analysis

Does the phrase “The First National Bank of Wal-Mart” strike a positive or negative chord? Wal-Mart isn’t a bank, but it does provide some financial services: it offers a no-fee Wal-Mart Discovery credit card with a 1 percent cash-back feature, cashes checks and sells money orders through an alliance with MoneyGram International, and houses bank branches in more than a thousand of its superstores. Through a partnering arrangement with SunTrust Banks, the retailer has also set up in-store bank operations at a number of outlets under the cobranded name of “Wal-Mart Money Center by SunTrust.” A few years ago, Wal-Mart made a bold attempt to buy several banks but dropped the idea when it encountered stiff opposition. Even so, some experts say that it’s not a matter of whether Wal-Mart will become a bank, but a matter of when. What’s your opinion? Should Wal-Mart be allowed to enter the financial-services industry and offer checking and savings accounts, mortgages, and personal and business loans? Who would benefit if Wal-Mart became a key player in the financial-services arena? Who would be harmed?

-

(AACSB) Analysis

Congratulations! You just won $10 million in the lottery. But instead of squandering your newfound wealth on luxury goods and a life of ease, you’ve decided to stay in town and be a financial friend to your neighbors, who are hardworking but never seem to have enough money to fix up their homes or buy decent cars. The best way, you decide, is to start a bank that will make home and car loans at attractive rates. On the day that you open your doors, the reserve requirement set by the Federal Reserve System is 10 percent. What’s the maximum amount of money you can lend to residents of the town? What if the Fed raises the reserve requirement to 12 percent? Then how much could you lend? In changing the reserve requirement from 10 percent to 12 percent, what’s the Fed trying to do—curb inflation or lessen the likelihood of a recession? Explain how the Fed’s action will contribute to this goal.

References

Duhigg, C., “Loan-Agency Woes Swell from a Trickle to a Torrent,” nytimes.com http://www.nytimes.com/2008/07/11/business/11ripple.html?ex=1373515200&en= 8ad220403fcfdf6e&ei=5124&partner=permalink&exprod=permalink (accessed November 11, 2011).

The Economist, “America’s Missing Middle,” The Economist, November 2011, 15.

FDIC, Quarterly Banking Profile (First Quarter 2008), at http://www.2.fdic.gov/qbp/2008mar/qbp.pdf (accessed September 25, 2008).

Federal Deposit Insurance Corporation, Quarterly Banking Profile (Fourth Quarter 2007), http://www.2.fdic.gov/qbp/2007dec/qbp.pdf (accessed September 25, 2008)

Insurance Information Institute, Financial Services Fact Book 2010, Banking: Commercial Banks, http://www.fsround.org/publications/pdfs/Financial_Services_Factbook_2010.pdf (accessed November 7, 2011).

Lahart, J., “Egg Cracks Differ in Housing, Finance Shells,” Wall Street Journal, http://online.wsj.com/article/SB119845906460548071.html?mod=googlenews_wsj (accessed November 7, 2011).

Mortgage Bankers Association, “Delinquencies and Foreclosures Increase in Latest MBA National Delinquency Survey,” September 5, 2008, http://www.mbaa.org/NewsandMedia/PressCenter/64769.htm (accessed November 11, 2011).

Pennsylvania Association of Community Bankers, “What’s the Difference?,” http://www.pacb.org/banks_and_banking/difference.html (accessed November 7, 2011).

RealtyTrac Inc., “Foreclosure Activity Increases 4 Percent in April,” realtytrac.com, http://www.realtytrac.com/content/press-releases/ (accessed November 7, 2011).

Robb, G., et al., “AIG Gets Fed Rescue in Form of $85 Billion Loan,” MarketWatch, September 16, 2008, http://www.marketwatch.com/story/aig-gets-fed-rescue-in-form-of-85-billion-loan (accessed November 7, 2011).

Tully, S., “Wall Street’s Money Machine Breaks Down,” Fortune, CNNMoney.com, November 12, 2007, http://money.cnn.com/magazines/fortune/fortune_archive/2007/11/26/101232838/index.htm (accessed November 7, 2011).

Wallack, T., “Sovereign Making Hub its Home Base,” Boston.com, http://articles.boston.com/2011-08-16/business/29893051_1_sovereign-spokesman-sovereign-bank-deposits-and-branches (accessed November 7, 2011).

Wells Fargo, https://www.wellsfargo.com/ (accessed November 7, 2011).