14.3 The Financial Planning Process

Learning Objectives

- Identify the three stages of the personal-finances planning process.

- Explain how to draw up a personal net-worth statement, a personal cash-flow statement, and a personal budget.

We’ve divided the financial planning process into three steps:

- Evaluate your current financial status by creating a net worth statement and a cash flow analysis.

- Set short-term, intermediate-term, and long-term financial goals.

- Use a budget to plan your future cash inflows and outflows and to assess your financial performance by comparing budgeted figures with actual amounts.

Step 1: Evaluating Your Current Financial Situation

Just how are you doing, financially speaking? You should ask yourself this question every now and then, and it should certainly be your starting point when you decide to initiate a more or less formal financial plan. The first step in addressing this question is collecting and analyzing the records of what you own and what you owe and then applying a few accounting terms to the results:

- Your personal assets consist of what you own.

- Your personal liabilities are what you owe—your obligations to various creditors, big and small.

Preparing Your Net-Worth Statement

Your net worth (accounting term for your wealth) is the difference between your assets and your liabilities. Thus the formula for determining net worth is:

Assets − Liabilities = Net worth

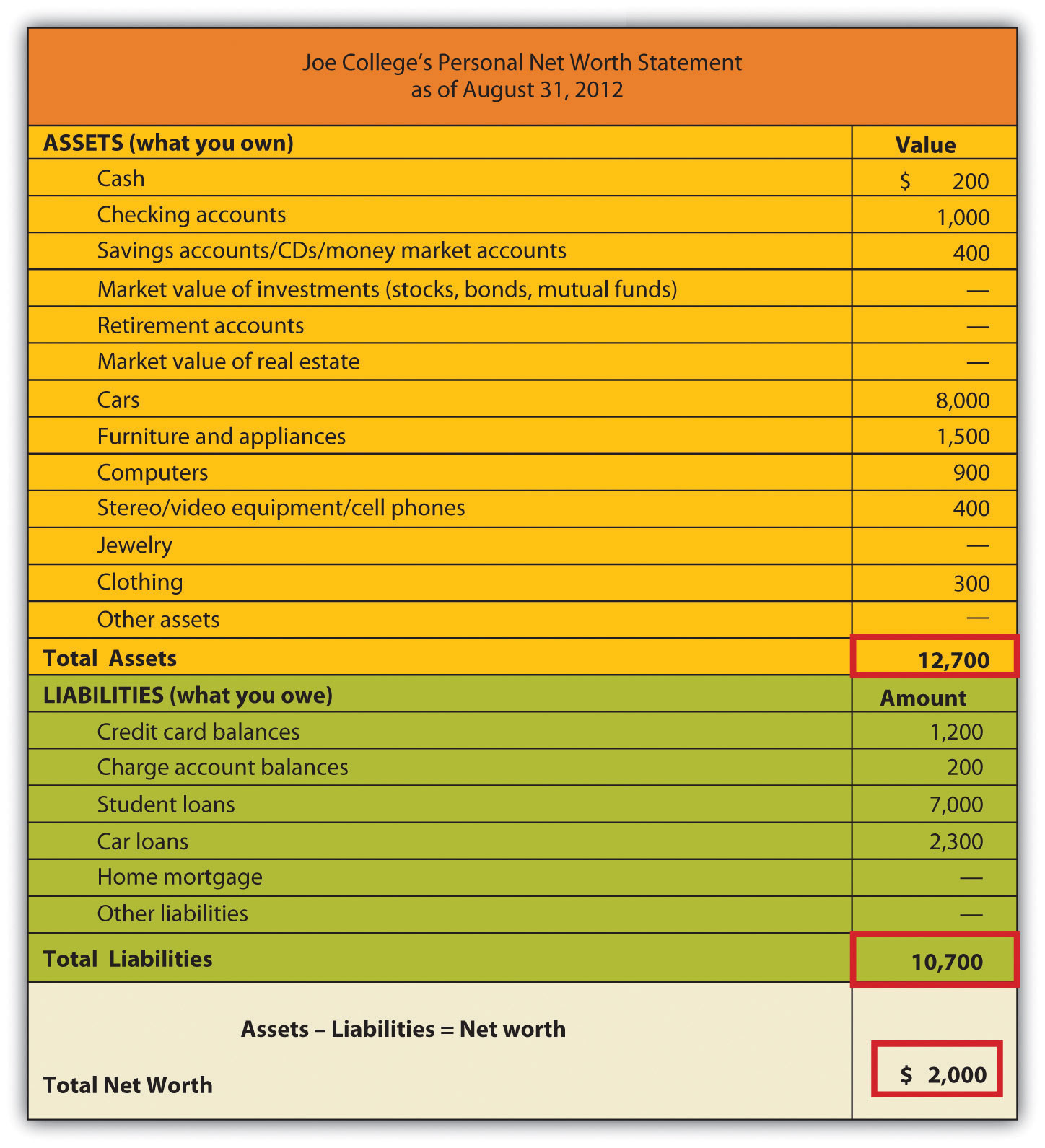

If you own more than you owe, your net worth will be positive; if you owe more than you own, it will be negative. To find out whether your net worth is on the plus or minus side, you can prepare a personal net worth statement like the one in Figure 14.6 “Net Worth Statement”, which we’ve drawn up for a fictional student named Joe College. (Note that we’ve included lines for items that may be relevant to some people’s net worth statements but left them blank when they don’t apply to Joe.)

Assets

Joe has two types of assets:

- First are his monetary or liquid assets—his cash, the money in his checking accounts, and the value of any savings, CDs, and money market accounts. They’re called liquid because either they’re cash or they can readily be turned into cash.

- Everything else is a tangible asset—something that Joe can use, as opposed to an investment. (We haven’t given Joe any investments—such financial assets as stocks, bonds, or mutual funds—because people usually purchase these instruments to meet such long-term goals as buying a house or sending a child to college.)

Note that we’ve been careful to calculate Joe’s assets in terms of their fair market value—the price he could get by selling them at present, not the price he paid for them or the price that he could get at some future time.

Liabilities

Joe’s net worth statement also divides his liabilities into two categories:

- Anything that Joe owes on such items as his furniture and computer are current liabilities—debts that must be paid within one year. Much of this indebtedness no doubt ends up on Joe’s credit card balance, which is regarded as a current liability because he should pay it off within a year.

- By contrast, his car payments and student-loan payments are noncurrent liabilities—debt payments that extend for a period of more than one year. Joe is in no position to buy a house, but for most people, their mortgage is their most significant noncurrent liability.

Finally, note that Joe has positive net worth. At this point in the life of the average college student, positive net worth may be a little unusual. If you happen to have negative net worth right now, you’re technically insolvent, but remember that a major goal of getting a college degree is to enter the workforce with the best possible opportunity for generating enough wealth to reverse that situation.

Preparing Your Cash-Flow Statement

Now that you know something about your financial status on a given date, you need to know more about it over a period of time. This is the function of a cash-flow or income statement, which shows where your money has come from and where it’s slated to go.

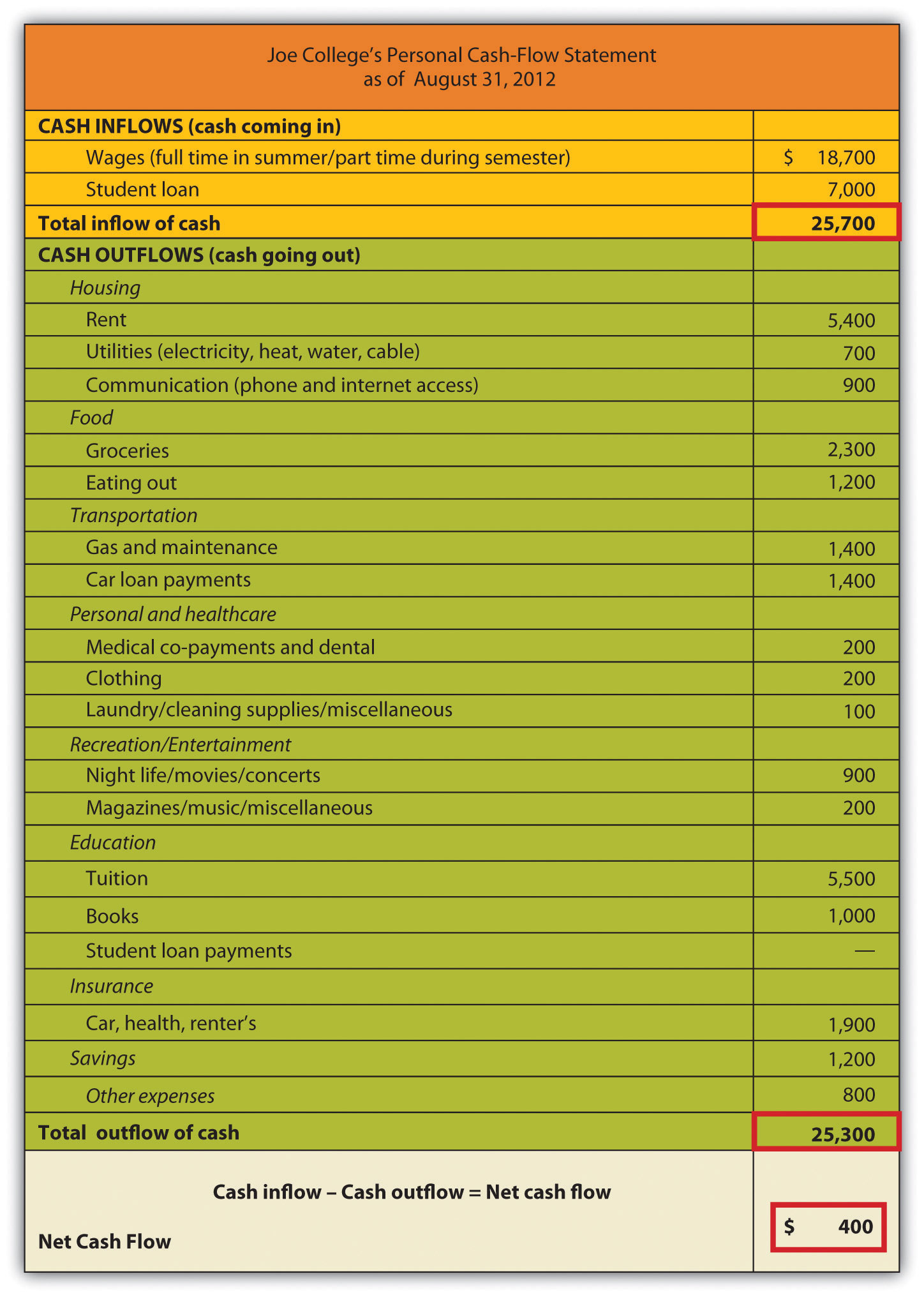

Figure 14.7 “Cash-Flow Statement” is Joe College’s cash-flow statement. As you can see, Joe’s income (his cash inflows—money coming in) is derived from two sources: student loans and income from a part-time job. His expenditures (cash outflows—money going out) fall into several categories: housing, food, transportation, personal and health care, recreation/entertainment, education, insurance, savings, and other expenses. To find out Joe’s net cash flow, we subtract his expenditures from his income:

$25,700 – $25,300 = $400

Joe has been able to maintain a positive cash flow for the year ending August 31, 2012, but he’s cutting it close. Moreover, he’s in the black only because of the inflow from student loans—income that, as you’ll recall from his net worth statement, is also a noncurrent liability. We are, however, willing to give Joe the benefit of the doubt: Though he’s incurring the high costs of an education, he’s willing to commit himself to the debt (and, we’ll assume, to careful spending) because he regards education as an investment that will pay off in the future.

Remember that when constructing a cash-flow statement, you must record only income and expenditures that pertain to a given period, whether it be a month, a semester, or (as in Joe’s case) a year. Remember, too, that you must figure both inflows and outflows on a cash basis: you record income only when you receive money, and you record expenditures only when you pay out money. When, for example, Joe used his credit card to purchase his computer, he didn’t actually pay out any money. Each monthly payment on his credit card balance, however, is an outflow that must be recorded on his cash-flow statement (according to the type of expense—say, recreation/entertainment, food, transportation, and so on).

Your cash-flow statement, then, provides another perspective on your solvency: if you’re insolvent, it’s because you’re spending more than you’re earning. Ultimately, your net worth and cash-flow statements are most valuable when you use them together. While your net worth statement lets you know what you’re worth—how much wealth you have—your cash-flow statement lets you know precisely what effect your spending and saving habits are having on your wealth.

Step 2: Set Short-Term, Intermediate-Term, and Long-Term Financial Goals

We know from Joe’s cash-flow statement that, despite his limited income, he feels that he can save $1,200 a year. He knows, of course, that it makes sense to have some cash in reserve in case of emergencies (car repairs, medical needs, and so forth), but he also knows that by putting away some of his money (probably each week), he’s developing a habit that he’ll need if he hopes to reach his long-term financial goals.

Just what are Joe’s goals? We’ve summarized them in Figure 14.8 “Joe’s Goals”, where, as you can see, we’ve divided them into three time frames: short-term (less than two years), intermediate-term (two to five years), and long-term (more than five years). Though Joe is still in an early stage of his financial life cycle, he has identified and structured his goals fairly effectively. In particular, they satisfy four criteria of well-conceived goals: they’re realistic and measurable, and Joe has designated both definite time frames and specific courses of action (Kapoor, et. al., 2007).

Figure 14.8 Joe’s Goals

| Short-term goals (less than 2 years) |

Intermediate-term goals (2-5 years) |

Long-term goals (more than 5 years) |

|---|---|---|

|

|

|

They’re also sensible. Joe sees no reason, for example, why he can’t pay off his car loan, credit card, and charge account balances within two years. Remember that, with no income other than student-loan money and wages from a part-time job, Joe has decided (rightly or wrongly) to use his credit cards to pay for much of his personal consumption (furniture, electronics equipment, and so forth). It won’t be an easy task to pay down these balances, so we’ll give him some credit (so to speak) for regarding them as important enough to include paying them among his short-term goals. After finishing college, he’ll splurge and take a month-long vacation. This might not be the best thing to do from a financial point of view, but he knows this could be his only opportunity to travel extensively. He is realistic in his classification of student loan repayment and the purchase of a home as long-term. But he might want to revisit his decision to classify saving for his retirement as a long-term goal. This is something we believe he should begin as soon as he starts working full-time.

Step 3: Develop a Budget and Use It to Evaluate Financial Performance

Once he has reviewed his cash-flow statement, Joe has a much better idea of what cash flowed in for the year that ended August 31, 2012, and a much better idea of where it went when it flowed out. Now he can ask himself whether he’s satisfied with his annual inflow (income) and outflow (expenditures). If he’s anything like most people, he’ll want to make some changes—perhaps to increase his income, to cut back on his expenditures, or, if possible, both. The first step in making these changes is drawing up a personal budget—a document that itemizes the sources of his income and expenditures for the coming year, along with the relevant money amounts for each.

Having reviewed the figures on his cash-flow statement, Joe did in fact make a few decisions:

- Because he doesn’t want to jeopardize his grades by increasing his work hours, he’ll have to reconcile himself to just about the same wages for another year.

- He’ll need to apply for another $7,000 student loan.

- If he’s willing to cut his spending by $1,200, he can pay off his credit cards. Toward this end, he’s targeted the following expenditures for reduction: rent (get a cheaper apartment), phone costs (switch plans), auto insurance (take advantage of a “good-student” discount), and gasoline (pool rides or do a little more walking). Fortunately, his car loan will be paid off by midyear.

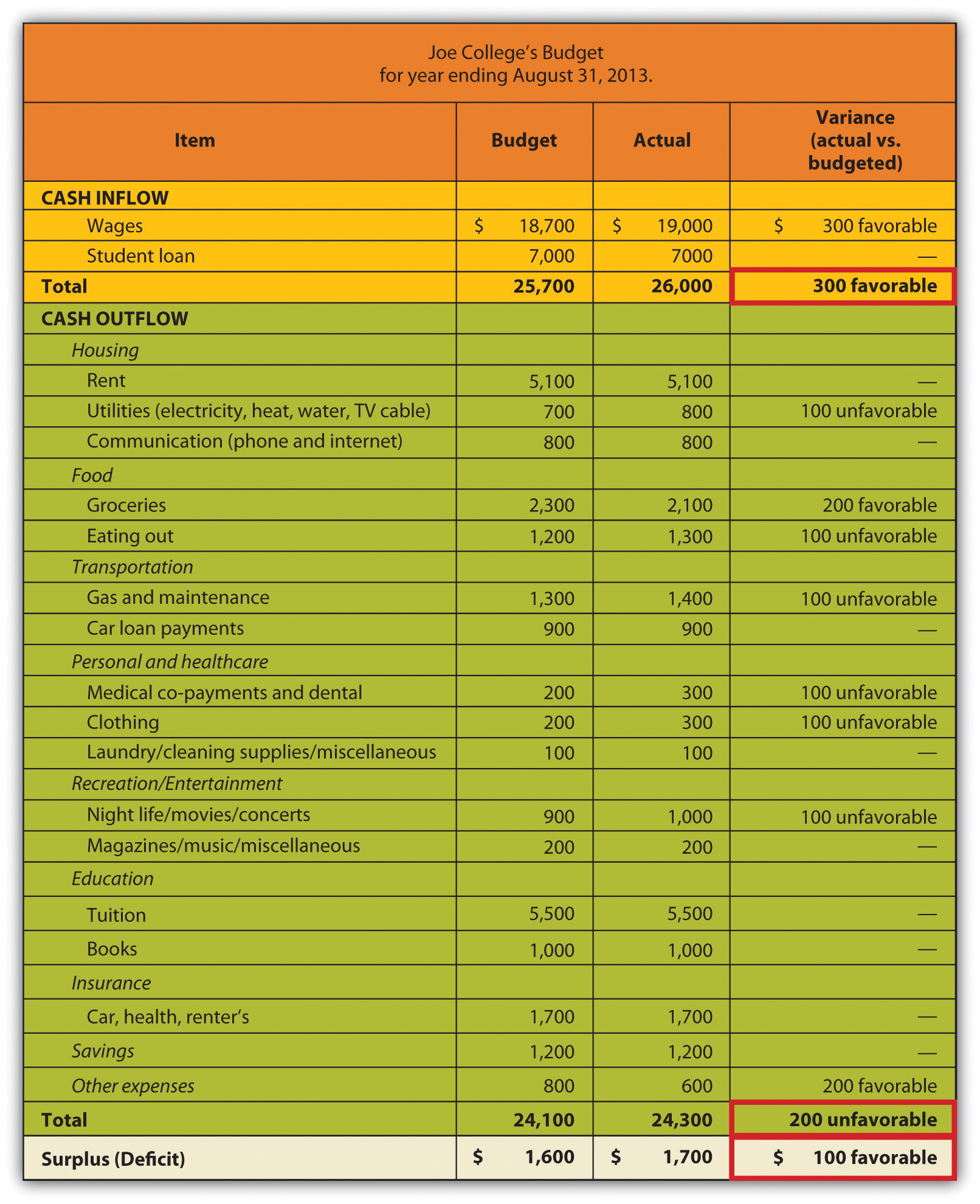

Revising his figures accordingly, Joe developed the budget in Figure 14.9 “Joe’s Budget” for the year ending August 31, 2013. Look first at the column headed “Budget.” If things go as planned, Joe expects a cash surplus of $1,600 by the end of the year—enough to pay off his credit card debt and leave him with an extra $400.

Figuring the Variance

Now we can examine the two remaining columns in Joe’s budget. Throughout the year, Joe will keep track of his actual income and actual expenditures and will enter the totals in the column labeled “Actual.” Like most reasonable people, however, Joe doesn’t really expect his actual figures to match with his budgeted figures. So whenever there’s a difference between an amount in his “Budget” column and the corresponding amount in his “Actual” column, Joe records the difference, whether plus or minus, as a variance. Two types of variances appear in Joe’s budget:

- Income variance. When actual income turns out to be higher than expected or budgeted income, Joe records the variance as “favorable.” (This makes sense, as you’d find it favorable if you earned more income than expected.) When it’s just the opposite, he records the variance as “unfavorable.”

- Expense variance. When the actual amount of an expenditure is more than he had budgeted for, he records it as an “unfavorable” variance. (This also makes sense, as you’d find it unfavorable if you spent more than the budgeted amount.) When the actual amount is less than budgeted, he records it as a “favorable” variance.

Setting Mature Goals

Before we leave the subject of the financial-planning process, let’s revisit the topic of Joe’s goals. Another look at Figure 14.8 “Joe’s Goals” reminds us that, at the current stage of his financial life cycle, Joe has set fairly simple goals. We know, for example, that Joe wants to buy a home, but when does he want to take this major financial step? And of course, Joe wants to retire, but what kind of lifestyle does he want in retirement? Does he expect, like most people, a retirement lifestyle that’s more or less comparable to that of his peak earning years? Will he be able to afford both the cost of a comfortable retirement and, say, the cost of sending his children to college? As Joe and his financial circumstances mature, he’ll have to express these goals (and a few others) in more specific terms.

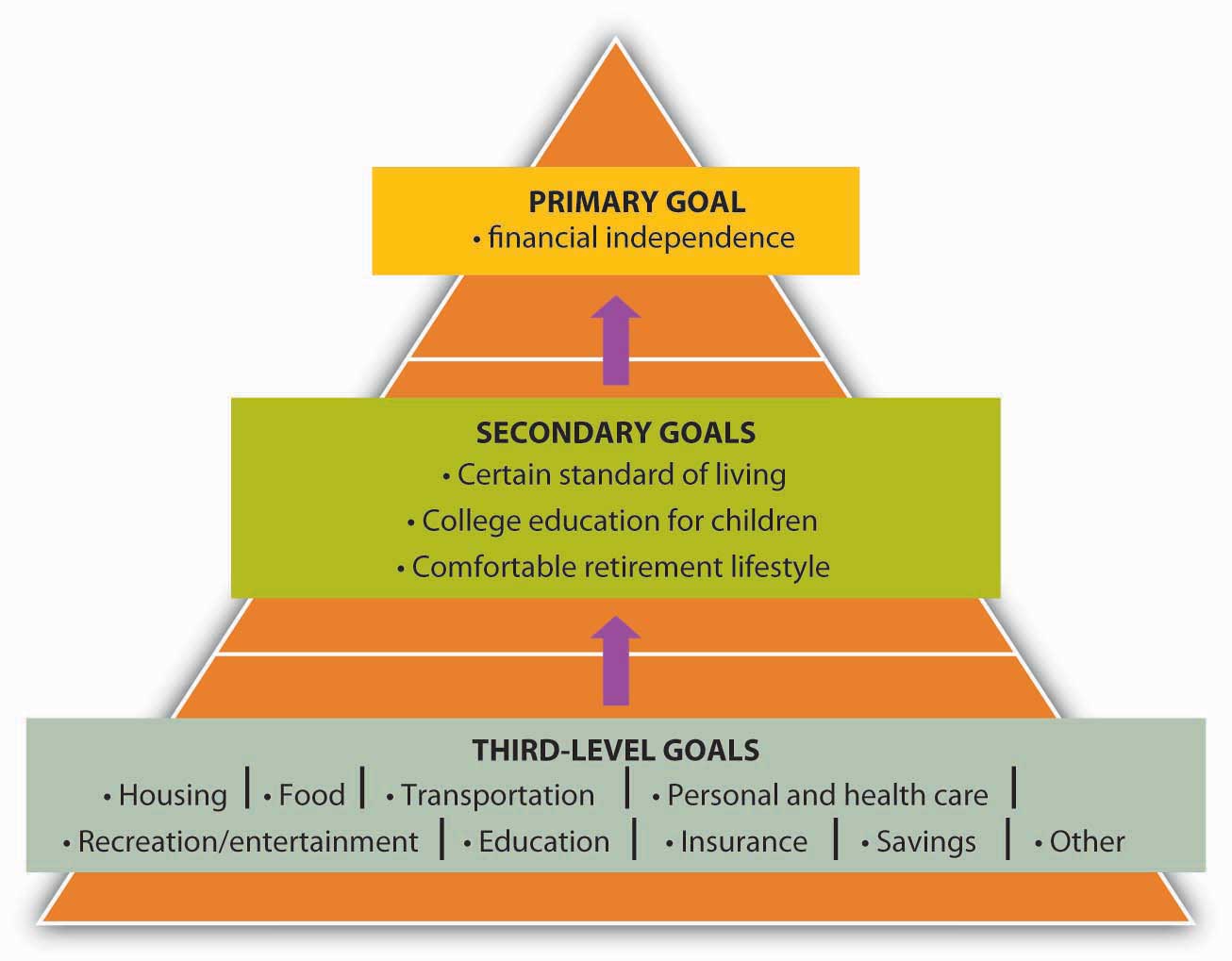

Levels of Mature Goals

Let’s fast-forward a decade or so, when Joe’s picture of stages 2 and 3 of his financial life cycle have come into clearer focus. If he hasn’t done so already, Joe is now ready to identify a primary goal to guide him in identifying and meeting all his other goals (Winger & Frasca, 2003). Suppose that because Joe’s investment in a college education has paid off the way he’d planned ten years ago, he’s in a position to target a primary goal of financial independence—by which he means a certain financially secure life not only for himself but for his children, as well. Now that he’s set this primary goal, he can identify a more specific set of goals—say, the following:

- A standard of living that reflects a certain level of comfort—a level associated with the possession of certain assets, both tangible and intangible.

- The ability to provide his children with college educations.

- A retirement lifestyle comparable to that of his peak earning years.

Having set this secondary level of goals, Joe’s now ready to make specific plans for reaching them. As we’ve already seen, Joe understands that plans are far more likely to work out when they’re focused on specific goals. His next step, therefore, is to determine the goals on which he should focus this next level of plans.

As it turns out, Joe already knows what these goals are, because he’s been setting the appropriate goals every year since he drew up the cash-flow statement in Figure 14.7 “Cash-Flow Statement”. In drawing up that statement, Joe was careful to create several line items to identify his various expenditures: housing, food, transportation, personal and health care, recreation/entertainment, education, insurance, savings, and other expenses. When we introduced these items, we pointed out that each one represents a cash outflow—something for which Joe expected to pay. They are, in other words, things that Joe intends to buy or, in the language of economics, consume. As such, we can characterize them as consumption goals. These “purchases”—what Joe wants in such areas as housing, insurance coverage, recreation/entertainment, and so forth—make specific his secondary goals and are therefore his third-level goals.

Figure 14.10 “Three-Level Goals/Plans” gives us a full picture of Joe’s three-level hierarchy of goals.

Present and Future Consumption Goals

A closer look at the list of Joe’s consumption goals reveals that they fall into two categories:

- We can call the first category present goals because each item is intended to meet Joe’s present needs and those (we’ll now assume) of his family—housing, health care coverage, and so forth. They must be paid for as Joe and his family take possession of them—that is, when they use or consume them. All these things are also necessary to meet the first of Joe’s secondary goals—a certain standard of living.

- The items in the second category of Joe’s consumption goals are aimed at meeting his other two secondary goals: sending his children to college and retiring with a comfortable lifestyle. He won’t take possession of these purchases until sometime in the future, but (as is so often the case) there’s a catch: they must be paid for out of current income.

A Few Words about Saving

Joe’s desire to meet this second category of consumption goals—future goals such as education for his kids and a comfortable retirement for himself and his wife—accounts for the appearance on his list of the one item that, at first glance, may seem misclassified among all the others: namely, savings.

Paying Yourself First

It’s tempting to glance at Joe’s budget and cash-flow statement and assume that he shares with most of us a common attitude toward saving money: when you’re done allotting money for various spending needs, you can decide what to do with what’s left over—save it or spend it. In reality, however, Joe’s budgeting reflects an entirely different approach. When he made up the budget in Figure 14.9 “Joe’s Budget”, Joe started out with the decision to save $1,600—or at least to avoid spending it. Why? Because he had a goal: to be free of credit card debt. To meet this goal, he planned to use $1,200 of his current income to pay off what would continue to hang over his head as a future expense (his credit card debt). In addition, he planned to have $400 left over after he’d paid his credit card balance. Why? Because he had still longer-term goals, and he intended to get started on them early—as soon as he finished college. Thus his intention from the outset was to put $400 into savings.

In other words, here’s how Joe went about budgeting his money for the year ending August 31, 2013 (as shown in Figure 14.9 “Joe’s Budget”):

- He calculated his income—total cash inflows from his student loan and his part-time job ($25,700).

- He subtracted from his total income two targeted consumption goals—credit card payments ($1,200) and savings ($400).

- He allocated what was left ($24,100) to his remaining consumption goals: housing ($6,600), food ($3,500), education ($6,500), and so forth.

If you’re concerned that Joe’s sense of delayed gratification is considerably more mature than your own, think of it this way: Joe has chosen to pay himself first. It’s one of the key principles of personal-finances planning and an important strategy in doing something that we recommended earlier in this chapter—starting early (Keown, 2007).

Key Takeaways

-

The financial planning process consists of three steps:

- Evaluate your current financial status by creating a net worth statement and a cash flow analysis.

- Set short-term, intermediate-term, and long-term financial goals.

- Use a budget to plan your future cash inflows and outflows and to assess your financial performance by comparing budgeted figures with actual amounts.

-

In step 1 of the financial planning process, you determine what you own and what you owe:

- Your personal assets consist of what you own.

- Your personal liabilities are what you owe—your obligations to various creditors.

-

Most people have two types of assets:

- Monetary or liquid assets include cash, money in checking accounts, and the value of any savings, CDs, and money market accounts. They’re called liquid because either they’re cash or they can readily be turned into cash.

- Everything else is a tangible asset—something that can be used, as opposed to an investment.

-

Likewise, most people have two types of liabilities:

- Any debts that should be paid within one year are current liabilities.

- Noncurrent liabilities consist of debt payments that extend for a period of more than one year.

- Your net worth is the difference between your assets and your liabilities. Your net worth statement will show whether your net worth is on the plus or minus side on a given date.

- In step 2 of the financial planning process, you create a cash-flow or income statement, which shows where your money has come from and where it’s slated to go. It reflects your financial status over a period of time. Your cash inflows—the money you have coming in—are recorded as income. Your cash outflows—money going out—are itemized as expenditures in such categories as housing, food, transportation, education, and savings.

- A good way to approach your financial goals is by dividing them into three time frames: short-term (less than two years), intermediate-term (two to five years), and long-term (more than five years). Goals should be realistic and measurable, and you should designate definite time frames and specific courses of action.

- Net worth and cash-flow statements are most valuable when used together: while your net worth statement lets you know what you’re worth, your cash-flow statement lets you know precisely what effect your spending and saving habits are having on your net worth.

- If you’re not satisfied with the effect of your spending and saving habits on your net worth, you may want to make changes in future inflows (income) and outflows (expenditures). You make these changes in step 3 of the financial planning process, when you draw up your personal budget—a document that itemizes the sources of your income and expenditures for a future period (often a year).

-

In addition to the itemized lists of inflows and outflows, there are three other columns in the budget:

- The “Budget” column tracks the amounts of money that you plan to receive or to pay out over the budget period.

- The “Actual” column records the amounts that did in fact come in or go out.

- The final column records the variance for each item—the difference between the amount in the “Budget” column and the corresponding amount in the “Actual” column.

-

There are two types of variance:

- An income variance occurs when actual income is higher than budgeted income (or vice versa).

- An expense variance occurs when the actual amount of an expenditure is higher than the budgeted amount (or vice versa).

Exercise

(AACSB) Analysis

Using your own information (or made-up information if you prefer), go through the three steps in the financial planning process:

- Evaluate your current financial status by creating a net worth statement and a cash flow analysis.

- Identify short-term, intermediate-term, and long-term financial goals.

- Create a budget (for a month or a year). Estimate future income and expenditures. Make up “actual” figures and calculate a variance by comparing budgeted figures with actual amounts.

References

Kapoor, J. R., Les R. Dlabay, and Robert J. Hughes, Personal Finance, 8th ed. (New York: McGraw-Hill, 2007), 81.

Keown, A. J., Personal Finance: Turning Money into Wealth, 4th ed. (Upper Saddle River, NJ: Pearson Education, 2007, 22 et passim.

Winger, B. J., and Ralph R. Frasca, Personal Finance: An Integrated Planning Approach, 6th ed. (Upper Saddle River, NJ: Prentice Hall, 2003), 57–58.