17.3 Macroeconomics for the 21st Century

Learning Objectives

- Discuss how the Fed incorporated a strong inflation constraint and lags into its policies from the 1980s onwards.

- Describe the fiscal policies that were undertaken from the 1980s onwards and their rationales.

- Discuss the challenges that events from the 1980s onwards raised for the monetarist and new classical schools of thought.

- Summarize the views and policy approaches of the new Keynesian school of economic thought.

Following the recession that ended in 1982, the last two decades of the 20th century and the early years of the 21st century have sometimes been referred to as the Great Moderation. Yes, there were recessions, but they were fairly mild and short-lived. Prematurely, economists began to pat themselves on the backs for having tamed the business cycle. There was a sense that macroeconomic theory and policy had helped with this improved performance. The ideas associated with macroeconomic theory and policy incorporated elements of Keynesian economics, monetarism, and new classical economics. All three schools of macroeconomic thought contributed to the development of a new school of macroeconomic thought: the new Keynesian school.

New Keynesian economics is a body of macroeconomic thought that stresses the stickiness of prices and the need for activist stabilization policies through the manipulation of aggregate demand to keep the economy operating close to its potential output. It incorporates monetarist ideas about the importance of monetary policy and new classical ideas about the importance of aggregate supply, both in the long and in the short run.

Another “new” element in new Keynesian economic thought is the greater use of microeconomic analysis to explain macroeconomic phenomena, particularly the analysis of price and wage stickiness. We saw in the chapter that introduced the model of aggregate demand and aggregate supply, for example, that sticky prices and wages may be a response to the preferences of consumers and of firms. That idea emerged from research by economists of the new Keynesian school.

New Keynesian ideas guide macroeconomic policy; they are the basis for the model of aggregate demand and aggregate supply with which we have been working. To see how the new Keynesian school has come to dominate macroeconomic policy, we shall review the major macroeconomic events and policies of the 1980s, 1990s, and early 2000s.

The 1980s and Beyond: Advances in Macroeconomic Policy

The exercise of monetary and of fiscal policy has changed dramatically in the last few decades.

The Revolution in Monetary Policy

It is fair to say that the monetary policy revolution of the last two decades began on July 25, 1979. On that day, President Jimmy Carter appointed Paul Volcker to be chairman of the Fed’s Board of Governors. Mr. Volcker, with President Carter’s support, charted a new direction for the Fed. The new direction damaged Mr. Carter politically but ultimately produced dramatic gains for the economy.

Oil prices rose sharply in 1979 as war broke out between Iran and Iraq. Such an increase would, by itself, shift the short-run aggregate supply curve to the left, causing the price level to rise and real GDP to fall. But expansionary fiscal and monetary policies had pushed aggregate demand up at the same time. As a result, real GDP stayed at potential output, while the price level soared. The implicit price deflator jumped 8.1%; the CPI rose 13.5%, the highest inflation rate recorded in the 20th century. Public opinion polls in 1979 consistently showed that most people regarded inflation as the leading problem facing the nation.

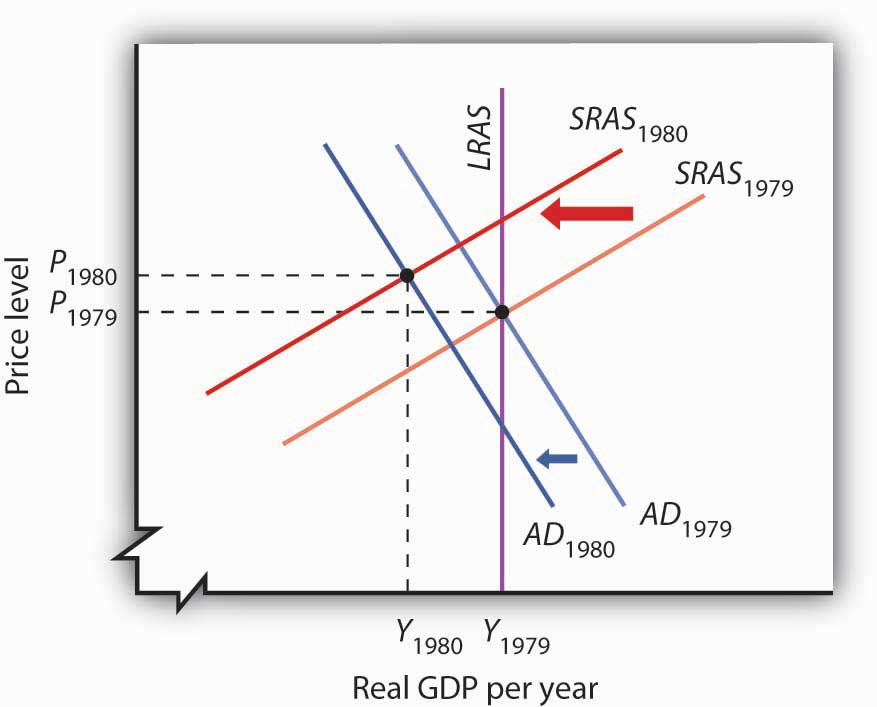

Figure 17.8 The Fed’s Fight Against Inflation

By 1979, expansionary fiscal and monetary policies had brought the economy to its potential output. Then war between Iran and Iraq caused oil prices to increase, shifting the short-run aggregate supply curve to the left. In the second half of 1979, the Fed launched an aggressive contractionary policy aimed at reducing inflation. The Fed’s action shifted the aggregate demand curve to the left. The result in 1980 was a recession with continued inflation.

Chairman Volcker charted a monetarist course of fixing the growth rate of the money supply at a rate that would bring inflation down. After the high rates of money growth of the past, the policy was sharply contractionary. Its first effects were to shift the aggregate demand curve to the left. Continued oil price increases produced more leftward shifts in the short-run aggregate supply curve, and the economy suffered a recession in 1980. Inflation remained high. Figure 17.8 “The Fed’s Fight Against Inflation” shows how the combined shifts in aggregate demand and short-run aggregate supply produced a reduction in real GDP and an increase in the price level.

The Fed stuck to its contractionary guns, and the inflation rate finally began to fall in 1981. But the recession worsened. Unemployment soared, shooting above 10% late in the year. It was, up to that point, the worst recession since the Great Depression. The inflation rate, though, fell sharply in 1982, and the Fed began to shift to a modestly expansionary policy in 1983. But inflation had been licked. Inflation, measured by the implicit price deflator, dropped to a 4.1% rate that year, the lowest since 1967.

The Fed’s actions represented a sharp departure from those of the previous two decades. Faced with soaring unemployment, the Fed did not shift to an expansionary policy until inflation was well under control. Inflation continued to edge downward through most of the remaining years of the 20th century and into the new century. The Fed has clearly shifted to a stabilization policy with a strong inflation constraint. It shifts to expansionary policy when the economy has a recessionary gap, but only if it regards inflation as being under control.

This concern about inflation was evident again when the U.S. economy began to weaken in 2008, and there was initially discussion among the members of the Federal Open Market Committee about whether or not easing would contribute to inflation. At that time, it looked like inflation was becoming a more serious problem, largely due to increases in oil and other commodity prices. Some members of the Fed, including Chairman Bernanke, argued that these price increases were likely to be temporary and the Fed began using expansionary monetary policy early on. By late summer and early fall, inflationary pressures had subsided, and all the members of the FOMC were behind continued expansionary policy. Indeed, at that point, the Fed let it be known that it was willing to do anything in its power to fight the current recession.

The next major advance in monetary policy came in the 1990s, under Federal Reserve Chairman Alan Greenspan. The Fed had shifted to an expansionary policy as the economy slipped into a recession when Iraq’s invasion of Kuwait in 1990 began the Persian Gulf War and sent oil prices soaring. By early 1994, real GDP was rising, but the economy remained in a recessionary gap. Nevertheless, the Fed announced on February 4, 1994, that it had shifted to a contractionary policy, selling bonds to boost interest rates and to reduce the money supply. While the economy had not reached its potential output, Chairman Greenspan explained that the Fed was concerned that it might push past its potential output within a year. The Fed, for the first time, had explicitly taken the impact lag of monetary policy into account. The issue of lags was also a part of Fed discussions in the 2000s.

Fiscal Policy: A Resurgence of Interest

President Ronald Reagan, whose 1980 election victory was aided by a recession that year, introduced a tax cut, combined with increased defense spending, in 1981. While this expansionary fiscal policy was virtually identical to the policy President Kennedy had introduced 20 years earlier, President Reagan rejected Keynesian economics, embracing supply-side arguments instead. He argued that the cut in tax rates, particularly in high marginal rates, would encourage work effort. He reintroduced an investment tax credit, which stimulated investment. With people working harder and firms investing more, he expected long-run aggregate supply to increase more rapidly. His policy, he said, would stimulate economic growth.

The tax cut and increased defense spending increased the federal deficit. Increased spending for welfare programs and unemployment compensation, both of which were induced by the plunge in real GDP in the early 1980s, contributed to the deficit as well. As deficits continued to rise, they began to dominate discussions of fiscal policy. In 1990, with the economy slipping into a recession, President George H. W. Bush agreed to a tax increase despite an earlier promise not to do so. President Bill Clinton, whose 1992 election resulted largely from the recession of 1990–1991, introduced another tax increase in 1994, with the economy still in a recessionary gap. Both tax increases were designed to curb the rising deficit.

Congress in the first years of the 1990s rejected the idea of using an expansionary fiscal policy to close a recessionary gap on grounds it would increase the deficit. President Clinton, for example, introduced a stimulus package of increased government investment and tax cuts designed to stimulate private investment in 1993; a Democratic Congress rejected the proposal. The deficit acted like a straitjacket for fiscal policy. The Bush and Clinton tax increases, coupled with spending restraint and increased revenues from economic growth, brought an end to the deficit in 1998.

Initially, it was expected that the budget surplus would continue well into the new century. But, this picture changed rapidly. President George W. Bush campaigned on a platform of large tax cuts, arguing that less government intervention in the economy would be good for long-term economic growth. His administration saw the enactment of two major pieces of tax-cutting legislation in 2001 and 2003. Coupled with increases in government spending, in part for defense but also for domestic purposes including a Medicare prescription drug benefit, the government budget surpluses gave way to budget deficits. To deal with times of economic weakness during President Bush’s administration, temporary tax cuts were enacted, both in 2001 and again in 2008.

As the economy continued to weaken in 2008, there was a resurgence of interest in using discretionary increases in government spending, as discussed in the Case in Point, to respond to the recession. Three factors were paramount: (1) the temporary tax cuts had provided only a minor amount of stimulus to the economy, as sizable portions had been used for saving rather than spending, (2) expansionary monetary policy, while useful, had not seemed adequate, and (3) the recession threatening the global economy was larger than those in recent economic history.

The Rise of New Keynesian Economics

New Keynesian economics emerged in the last three decades as the dominant school of macroeconomic thought for two reasons. First, it successfully incorporated important monetarist and new classical ideas into Keynesian economics. Second, developments in the 1980s and 1990s shook economists’ confidence in the ability of the monetarist or the new classical school alone to explain macroeconomic change.

Monetary Change and Monetarism

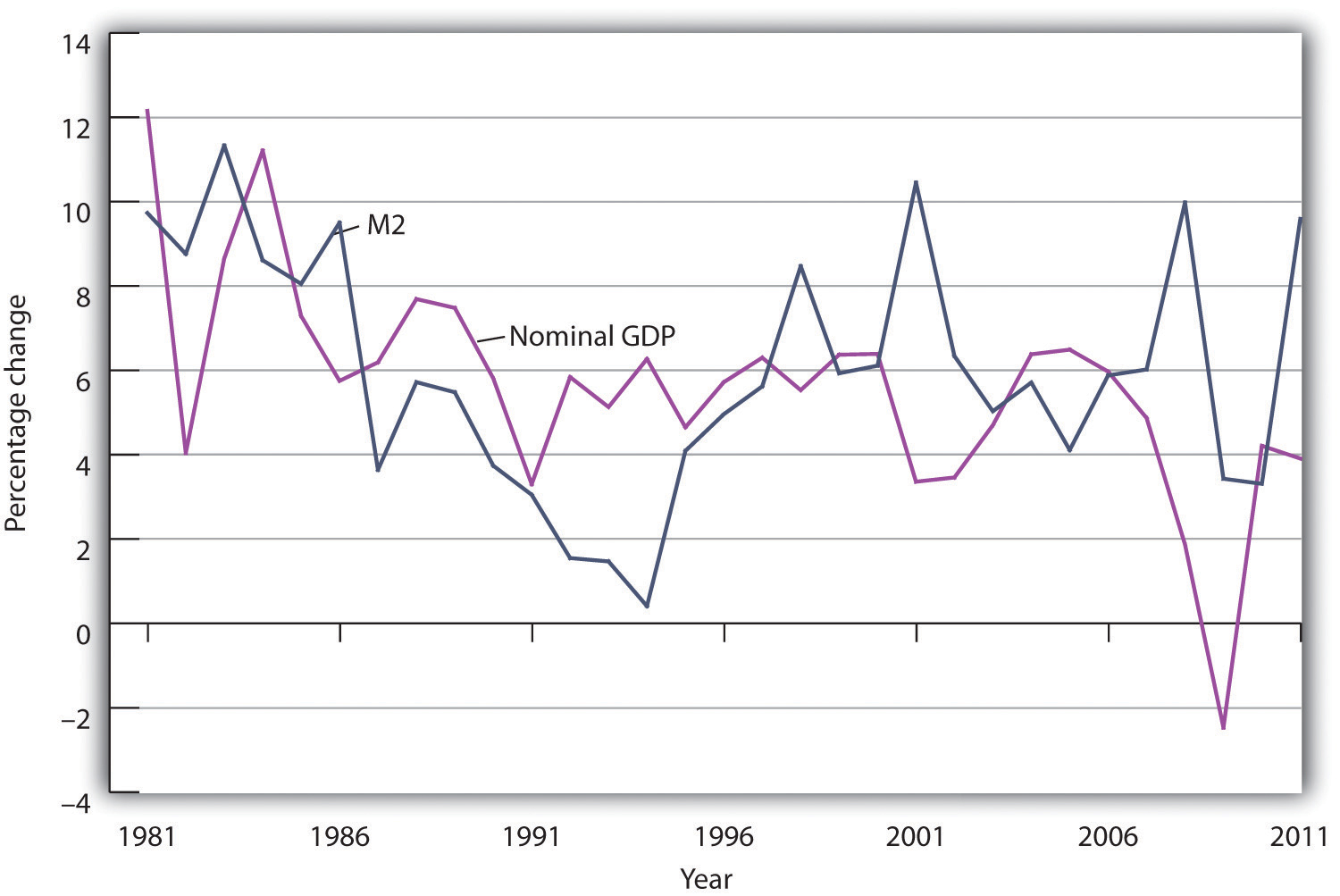

Look again at Figure 17.6 “M2 and Nominal GDP, 1960–1980”. The close relationship between M2 and nominal GDP in the 1960s and 1970s helped win over many economists to the monetarist camp. Now look at Figure 17.9 “M2 and Nominal GDP, 1980–2011”. It shows the same two variables, M2 and nominal GDP, from the 1980s through 2011. The tidy relationship between the two seems to have vanished. What happened?

The sudden change in the relationship between the money stock and nominal GDP has resulted partly from public policy. Deregulation of the banking industry in the early 1980s produced sharp changes in the ways individuals dealt with money, thus changing the relationship of money to economic activity. Banks have been freed to offer a wide range of financial alternatives to their customers. One of the most important developments has been the introduction of bond funds offered by banks. These funds allowed customers to earn the higher interest rates paid by long-term bonds while at the same time being able to transfer funds easily into checking accounts as needed. Balances in these bond funds are not counted as part of M2. As people shifted assets out of M2 accounts and into bond funds, velocity rose. That changed the once-close relationship between changes in the quantity of money and changes in nominal GDP.

Many monetarists have argued that the experience of the 1980s, 1990s, and 2000s reinforces their view that the instability of velocity in the short run makes monetary policy an inappropriate tool for short-run stabilization. They continue to insist, however, that the velocity of M2 remains stable in the long run. But the velocity of M2 appears to have diverged in recent years from its long-run path. Although it may return to its long-run level, the stability of velocity remains very much in doubt. Because of this instability, in 2000, when the Fed was no longer required by law to report money target ranges, it discontinued the practice.

The New Classical School and Responses to Policy

New classical economics suggests that people should have responded to the fiscal and monetary policies of the 1980s in predictable ways. They did not, and that has created new doubts among economists about the validity of the new classical argument.

The rational expectations hypothesis predicts that if a shift in monetary policy by the Fed is anticipated, it will have no effect on real GDP. The slowing in the rate of growth of the money supply over the period from 1979 to 1982 was surely well known. The Fed announced at the outset what it was going to do, and then did it. It had the full support first of President Carter and then of President Reagan. But the policy plunged the economy into what was then its worst recession since the Great Depression. The experience hardly seemed consistent with new classical logic. New classical economists argued that people may have doubted the Fed would keep its word, but the episode still cast doubt on the rational expectations argument.

The public’s response to the huge deficits of the Reagan era also seemed to belie new classical ideas. One new classical argument predicts that people will increase their saving rate in response to an increase in public sector borrowing. The resultant reduction in consumption will cancel the impact of the increase in deficit-financed government expenditures. But the private saving rate in the United States fell during the 1980s. New classical economists contend that standard measures of saving do not fully represent the actual saving rate, but the experience of the 1980s did not seem to support the new classical argument.

The events of the 1980s do not suggest that either monetarist or new classical ideas should be abandoned, but those events certainly raised doubts about relying solely on these approaches. Similarly, doubts about Keynesian economics raised by the events of the 1970s led Keynesians to modify and strengthen their approach.

A Macroeconomic Consensus?

While there is less consensus on macroeconomic policy issues than on some other economic issues (particularly those in the microeconomic and international areas), surveys of economists generally show that the new Keynesian approach has emerged as the preferred approach to macroeconomic analysis. The finding that about 80% of economists agree that expansionary fiscal measures can deal with recessionary gaps certainly suggests that most economists can be counted in the new Keynesian camp. Neither monetarist nor new classical analysis would support such measures. At the same time, there is considerable discomfort about actually using discretionary fiscal policy, as the same survey shows that about 70% of economists feel that discretionary fiscal policy should be avoided and that the business cycle should be managed by the Fed (Fuller & Geide-Stevenson, 2003). Just as the new Keynesian approach appears to have won support among most economists, it has become dominant in terms of macroeconomic policy. In the United States, the Great Recession was fought using traditional monetary and fiscal policies, while other policies were used concurrently to deal with the financial crisis that occurred at the same time.

Did the experience of the 2007–2009 recession affect economists’ views concerning macroeconomic policy? One source for gauging possible changes in the opinions of economists is the twice-yearly survey of economic policy among the National Association for Business Economics (NABE) (National Association for Business Economics, 2009). According to the August 2010 survey of 242 members of NABE, almost 60% were supportive of monetary policy at that time, which was expansionary and continued to be so at least through the middle of 2012. Concerning fiscal policy, there was less agreement. Still, according to the survey taken at the time the 2009 fiscal stimulus was being debated, 22% characterized it as “about right,” another third found it too restrictive, and only one third found it too stimulative. In the August 2010 survey, 39% thought fiscal policy “about right,” 24% found it too restrictive, and 37% found it too stimulative. Also, nearly 75% ranked promotion of economic growth as more important than deficit reduction, roughly two thirds supported the extension of unemployment benefits, and 60% agreed that awarding states with federal assistance funds from the 2009 stimulus package was appropriate. Taken together, the new Keynesian approach still seems to reflect the dominant opinion.

Is the Great Moderation Over?

As did the Great Depression of the 1930s, the Great Recession of the late 2000s generated great fear. Even though it officially ended in the middle of 2009, the state of the economy was the major issue over which the 2012 U.S. presidential election was fought, as the two major political parties offered their competing visions. Unemployment was still high, the housing sector had still not recovered, and the European debt situation loomed in the background. Another lurking question was whether the experience of the recent deep recession, the related financial crisis, and the slow recovery from them would become the new “normal” or whether macroeconomic performance would return to being less volatile.

Economist Todd Clark at the Federal Reserve Bank of Kansas attempted to answer this question (Clark, 2009). He first looked at the various explanations for the lower volatility of the U.S. economy during the 25-year period that preceded the Great Recession. Three broad reasons were given: structural changes, improved monetary policy, and good luck. While there is disagreement in the literature as to the relative importance of each of these, Clark argues that there is no reason to assume that the first two explanations for moderation will not continue to have moderating influences. For example, one positive structural change has been better inventory management, and he sees no reason why firms should become less able in the future to manage their inventories using the newly developed techniques. Similarly, in the future, monetary authorities should be able to continue to make the better decisions that they made during the Great Moderation. The element that can vary is luck. During the Great Moderation, the economy experienced fewer serious shocks. For example, oil prices were fairly stable. In contrast, during the recent recession, the price of oil rose from $54 per barrel in January 2007 to $134 per barrel in June 2008. The bursting of the housing price bubble and the ensuing crisis in financial markets was another major shock contributing to the depth and length of the recent recession. Clark says, “Accordingly, once the crisis subsides and the period of very bad luck passes, macroeconomic volatility will likely decline. In the future, the permanence of structural change and improved monetary policy that occurred in years past should ensure that low volatility is the norm” (Ibid., 27). Let’s hope that he is correct.

Key Takeaways

- The actions of the Fed starting in late 1979 reflected a strong inflation constraint and a growing recognition of the impact lag for monetary policy.

- Reducing the deficit dominated much of fiscal policy discussion during the 1980s and 1990s.

- The events of the 1980s and early 1990s do not appear to have been consistent with the hypotheses of either the monetarist or new classical schools.

- New Keynesian economists have incorporated major elements of the ideas of the monetarist and new classical schools into their formulation of macroeconomic theory.

Try It!

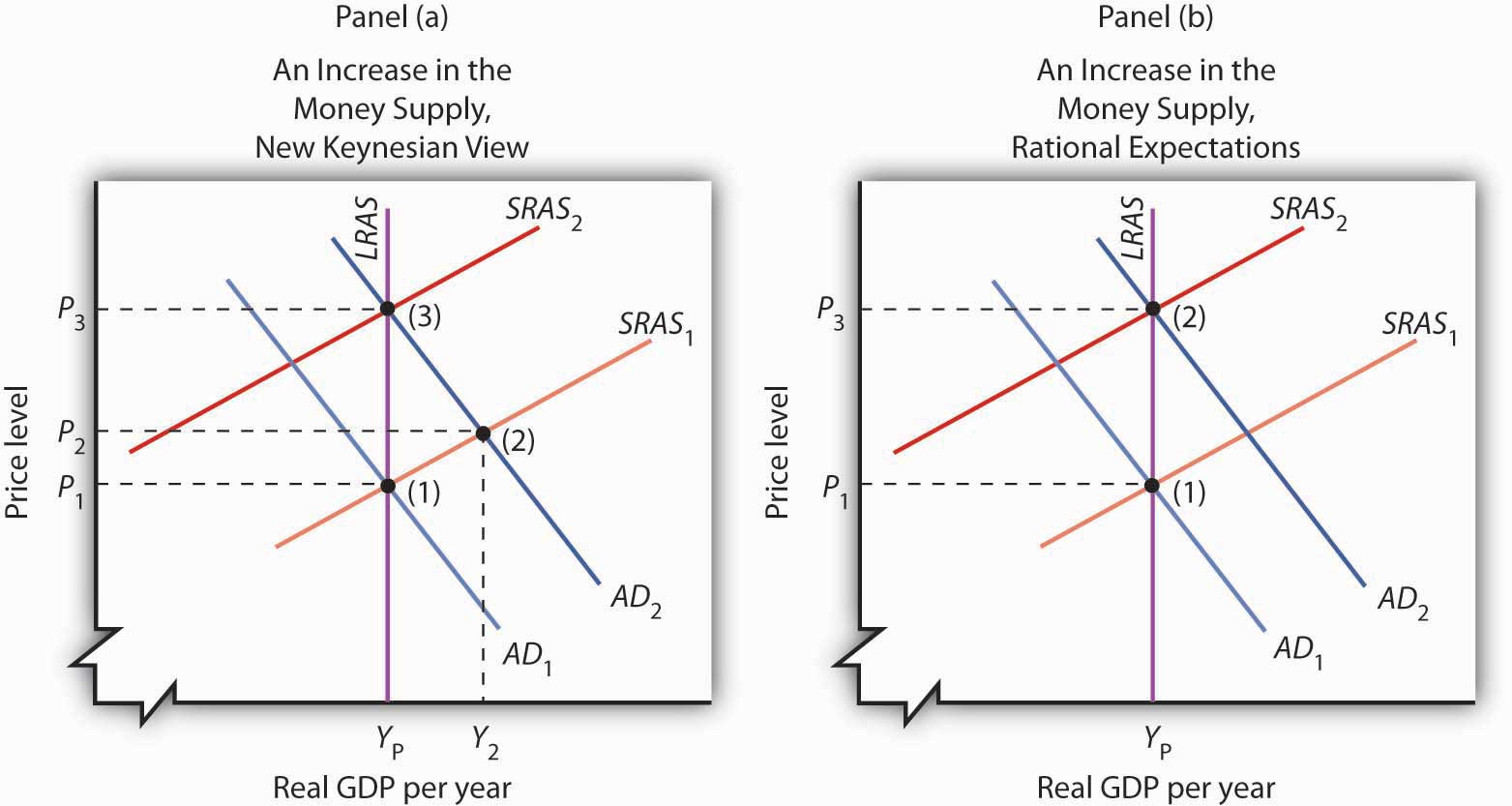

Show the effect of an expansionary monetary policy on real GDP

- according to new Keynesian economics

- according to the rational expectations hypothesis

In both cases, consider both the short-run and the long-run effects.

Case in Point: Steering on a Difficult Course

Sean MacEntee – steering wheel – CC BY 2.0.

Imagine that you are driving a test car on a special course. You get to steer, accelerate, and brake, but you cannot be sure whether the car will respond to your commands within a few feet or within a few miles. The windshield and side windows are blackened, so you cannot see where you are going or even where you are. You can only see where you have been with the rear-view mirror. The course is designed so that you will face difficulties you have never experienced. Your job is to get through the course unscathed. Oh, and by the way, you have to observe the speed limit, but you do not know what it is. Have a nice trip.

Now imagine that the welfare of people all over the world will be affected by how well you drive the course. They are watching you. They are giving you a great deal of often-conflicting advice about what you should do. Thinking about the problems you would face driving such a car will give you some idea of the obstacle course fiscal and monetary authorities must negotiate. They cannot know where the economy is going or where it is—economic indicators such as GDP and the CPI only suggest where the economy has been. And the perils through which it must steer can be awesome indeed.

One policy response that most acknowledge as having been successful was how the Fed dealt with the financial crises in Southeast Asia and elsewhere that shook the world economy in 1997 and 1998. There were serious concerns at the time that economic difficulties around the world would bring the high-flying U.S. economy to its knees and worsen an already difficult economic situation in other countries. The Fed had to steer through the pitfalls that global economic crises threw in front of it.

In the fall of 1998, the Fed chose to accelerate to avoid a possible downturn. The Federal Open Market Committee (FOMC) engaged in expansionary monetary policy by lowering its target for the federal funds rate. Some critics argued at the time that the Fed’s action was too weak to counter the impact of world economic crisis. Others, though, criticized the Fed for undertaking an expansionary policy when the U.S. economy seemed already to be in an inflationary gap.

In the summer of 1999, the Fed put on the brakes, shifting back to a slightly contractionary policy. It raised the target for the federal funds rate, first to 5.0% and then to 5.25%. These actions reflected concern about speeding when in an inflationary gap.

But was the economy speeding? Was it in an inflationary gap? Certainly, the U.S. unemployment rate of 4.2% in the fall of 1999 stood well below standard estimates of the natural rate of unemployment. There were few, if any, indications that inflation was a problem, but the Fed had to recognize that inflation might not appear for a very long time after the Fed had taken a particular course. As noted in the text, this was also during a time when the once-close relationship between money growth and nominal GDP seemed to break down. The shifts in demand for money created unexplained and unexpected changes in velocity.

The outcome of the Fed’s actions has been judged a success. While with 20/20 hindsight the Fed’s decisions might seem obvious, in fact it was steering a car whose performance seemed less and less predictable over a course that was becoming more and more treacherous.

Since 2008, both the Fed and the government have been again trying to get the economy back on track. In this case, the car was already in the ditch. The Fed decided on a “no holds barred” approach. It moved aggressively to lower the federal funds rate target and engaged in a variety of other measures to improve liquidity to the banking system, to lower other interest rates by purchasing longer-term securities (such as 10-year treasuries and those of Fannie Mae and Freddie Mac), and, working with the Treasury Department, to provide loans related to consumer and business debt.

Continuing on smaller expansionary fiscal policy begun under President George W. Bush, the Obama administration for its part advocated and Congress passed a massive spending and tax relief package of more than $800 billion. Besides the members of his economic team, many economists seem to be on board in using discretionary fiscal policy in this instance. Federal Reserve Bank of San Francisco President Janet Yellen put it this way: “The new enthusiasm for fiscal stimulus, and particularly government spending, represents a huge evolution in mainstream thinking.” A notable convert to using fiscal policy to deal with this recession was Harvard economist and former adviser to President Ronald Reagan, Martin Feldstein. His spending proposal encouraged increased military spending and he stated, “While good tax policy can contribute to ending the recession, the heavy lifting will have to be done by increased government spending.”

Predictably, not all economists jumped onto the fiscal policy bandwagon. Concerns included whether so-called shovel-ready projects could really be implemented in time, whether government spending would crowd out private spending, whether monetary policy alone was providing enough stimulus, and whether the spending would flow efficiently to truly worthwhile projects. As discussed elsewhere in this text, the controversy persists. But the fact that a variety of expansionary policies were used to ease the recession and spur the recovery is not in doubt.

Sources: Ben S. Bernanke, “The Crisis and the Policy Response” (speech, London School of Economics, January 13, 2009); Louis Uchitelle, “Economists Warm to Government Spending but Debate Its Form,” New York Times, January 7, 2009, p. B1.

Answer to Try It! Problem

Panel (a) shows an expansionary monetary policy according to new Keynesian economics. Aggregate demand increases, with no immediate reduction in short-run aggregate supply. Real GDP rises to Y2. In the long run, nominal wages rise, reducing short-run aggregate supply and returning real GDP to potential. Panel (b) shows what happens with rational expectations. When the Fed increases the money supply, people anticipate the rise in prices. Workers and firms agree to an increase in nominal wages, so that there is a reduction in short-run aggregate supply at the same time there is an increase in aggregate demand. The result is no change in real GDP; it remains at potential. There is, however, an increase in the price level.

References

Clark, T. E., “Is the Great Moderation Over? An Empirical Analysis,” Federal Reserve Bank of Kansas City Economic Review 94, no. 4 (Fourth Quarter 2009): 5–42.

Fuller, F. and Doris Geide-Stevenson, “Consensus among Economists: Revisited,” Journal of Economic Education 34, no. 4 (Fall 2003): 369–87.

Ibid., 27.

National Association for Business Economics, Economic Policy Surveys, March 2009 and August 2010, available at http://www.nabe.com.